About Blade Labs

We build cutting-edge technology focused on reducing friction for enterprises. Founded in January 2022, we started with seamless digital wallet technology that delivered significant network impact, increasing accounts by 50% across the network within our first year.

From 2024, we combined our digital wallet expertise with AI capabilities to create ZeroH, our AI-native GRC platform with blockchain-backed audit trails. ZeroH makes the implementation of regulated workflows and products seamless and automated, with our first use cases being Islamic and sustainable finance.

Foundation

- Founded: January 2022

- Headquarters: Singapore (Blade Labs Holdings Pte Ltd)

- Regional Office: Qatar (Blade Labs LLC, QFC Tower Doha)

Licenses & Certifications

- QFC Licensed Fintech: QFC #02389

- Security: SOC 2 Type II, ISO 27001:2022

- Privacy: GDPR Compliant

- Shariah: Fatwa Certified (Amanie Advisors)

Result: Governance becomes automatic, transparent, and verifiable. Not a burden.

What Makes Us Different

Enterprise DNA

Founded by veterans of Citigroup, Deutsche Bank, and Hedera. We understand enterprise compliance because we have lived it at the highest levels of global finance.

Domain Expertise

Deep knowledge of Islamic Finance (AAOIFI, IFSB), sustainability reporting, and regulated industries. We are specialists, not generalists building another horizontal GRC tool.

Deployment Track Record

Live in the Qatar Financial Center with QDB and Al Rayan Bank. We ship production systems, not demos. Our technology runs real compliance workflows for real institutions.

Strategic Backing

Portfolio company of Qatar Development Bank. Backed by The Hashgraph Association. Grantee of Hedera Foundation and Google Cloud. We have the support to scale.

Leadership Team

Founded by finance and technology veterans with 40+ combined years of experience across traditional banking, blockchain technology, and AI.

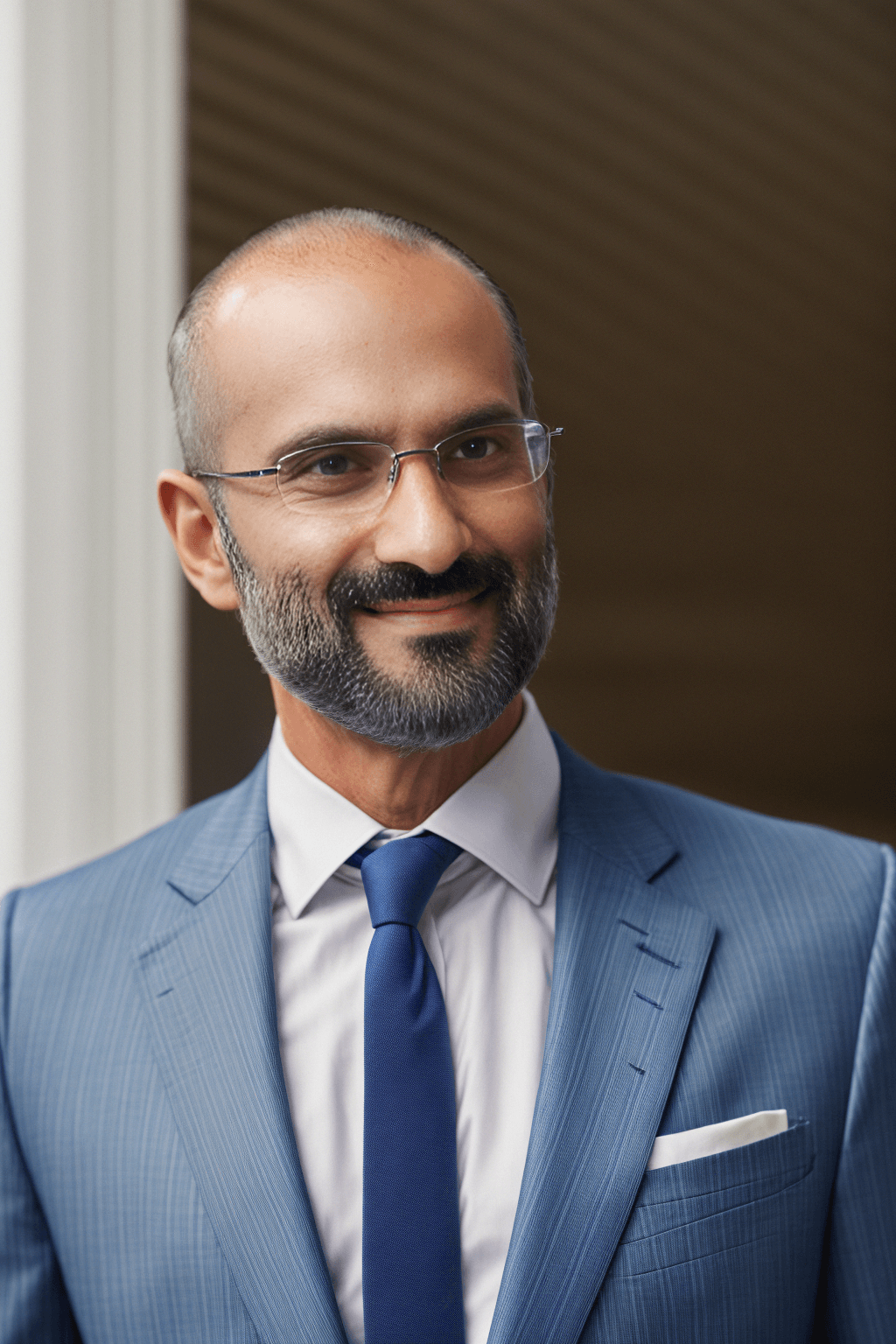

Sami Mian

Chief Executive Officer

- •20+ years financial services (Citigroup, Deutsche Bank)

- •10 years enterprise blockchain

- •3 years AI

- •Former Head of APAC, Hedera

- •Duke University

Valera Oleksiienko

Chief Technology Officer

- •11+ years software engineering

- •5 years blockchain

- •3 years AI

- •Enterprise fintech architecture veteran

Intesar Haquani

Chief Business Officer

- •20+ years business development & go-to-market

- •4 years blockchain

- •2 years AI

- •University of St Andrews

Combined Expertise

40+

Years Financial Services

15+

Years Blockchain

8+

Years AI

2

International Awards 2025

Awards & Recognition

Blade Labs' ZeroH platform has earned international recognition for delivering measurable outcomes that transform Islamic Finance compliance operations.

.png&w=3840&q=75&dpl=dpl_BgaU5bEJumysgsWr9NpU4y5Gdaq3)

Recognition That Validates Our Mission

In 2025, Blade Labs earned two international awards recognizing our impact on Islamic Finance technology and governance infrastructure.

The Finopitch Tokyo 2025 International Grand Prize for Sustainable ESG Islamic Finance Platform and the Islamic Fintech Awards Dubai 2025 Best Startup honor validate our approach: turning regulatory complexity into automated workflows with cryptographic proof.

These awards reflect the trust that institutions like Qatar Development Bank, Al Rayan Bank, and QFC have placed in our technology, and our commitment to making authentic Islamic Finance more accessible.

Finopitch Tokyo 2025

International Grand Prize

Recognized for innovation in Islamic Finance technology and GRC automation

2025

Islamic Fintech Awards 2025

Best Islamic Fintech Startup

Awarded for impact on Islamic Finance operational efficiency and compliance

Dubai • 2025

Fatwa Certification

Shariah Compliance Approval

Platform methodology and workflows certified by Amanie Advisors' Shariah Supervisory Board

Amanie Advisors

What These Awards Validate

Strategic Partnerships

Blade Labs partners with leading financial institutions, development banks, and regulators to modernize compliance infrastructure across highly regulated industries.

Our Partners

The Hashgraph Association

Investor

Investment Association Engine UK

Member

Tokenised Commodity Council

Board Member

Hedera Foundation | Google Cloud

Grantee

Partner Opportunities

Financial Institutions

Banks, Insurance, Asset Managers

- •Launch new regulated products faster (weeks vs. months)

- •Automate compliance reporting across frameworks

- •Reduce compliance FTE requirements

- •Enable multi-jurisdiction product expansion

Development Banks

Impact & Sustainable Finance

- •Scale sustainable finance programs (green bonds, impact lending)

- •Track ESG and impact metrics with blockchain verification

- •Enable smallholder/SME access to ethical financing

- •Demonstrate outcomes with verifiable, auditable data

Advisory & Governance Boards

Compliance Committees, Shariah Boards

- •Streamline decision tracking and certification workflows

- •Issue verifiable digital certificates for approvals

- •Monitor compliance across multiple institutions

- •Provide transparent governance for stakeholders

Regulators & Government

Regulatory Entities

- •Pilot blockchain-based regulatory reporting

- •Enable real-time compliance oversight

- •Standardize governance frameworks across jurisdictions

- •Foster innovation through regulatory sandboxes

Ready to Transform Your Compliance Operations?

Schedule a demo to see ZeroH in action, or contact our partnership team to discuss how we can help your organization.

Partnership inquiries: hello@bladelabs.io

Deployments and Use Cases

From live deployments to emerging use cases, ZeroH supports a wide range of financial products and workflows: cutting-edge sustainable finance, traditional Shariah-compliant structures, and environmental compliance for regulated industries.

Qatar Financial Center - Digital Receipt System

Al Rayan Bank

Announced September 8, 2025

Challenge

Islamic financial institutions must comply with 50+ AAOIFI standards (FAS, GSS, SSB) with manual policy tracking and reporting.

Solution

ZeroH automates AAOIFI obligation extraction, Shariah Supervisory Board workflow management, independence controls for SSB members, quarterly/annual disclosure generation, and fatwa management with blockchain-verified audit trails.

Result

First blockchain-backed Shariah compliance platform deployed in QFC Digital Asset Lab. Institutions maintain AAOIFI compliance continuously with automated workflows.

Portfolio company of Qatar Development Bank

Deployed with Al Rayan Bank

Blockchain-anchored audit trails

Digital Receipt System designation by QFC

Livestock Impact Investments

Development Bank Partnership

Challenge

Smallholder farmers need ethical financing, but manual compliance makes livestock financing operationally expensive for institutions.

Solution

ZeroH automates Shariah compliance verification, supply chain traceability (farm-to-market blockchain tracking), multi-stakeholder workflows, impact metrics, and audit trails.

Result

Institutions can offer livestock financing at scale with full traceability and Shariah compliance assurance.

Pilot deployment with development bank

Farm-to-market supply chain tracking

Impact metrics and ESG reporting

Multi-stakeholder coordination

Green Sukuk Issuance

GCC and Malaysia Markets

Challenge

Green Sukuk require verified environmental impact AND Shariah compliance, doubling the documentation burden.

Solution

ZeroH provides dual compliance workflows (environmental + Shariah), automated ESG data collection, transparent profit distribution tracking, blockchain-backed impact reports, and Shariah Board certification as verifiable digital certificates.

Result

Issuers can launch green Sukuk with credible sustainability claims and full Shariah governance transparency.

Dual compliance: Environmental + Shariah

Automated ESG data collection

Blockchain-backed impact reporting

Shariah Board digital certificates

Japan Impact GRC

Japanese Enterprises

Challenge

4,000 listed companies face mandatory TCFD/SSBJ disclosure. 747 GX League companies account for 50%+ of national emissions and need carbon credit tracking with GX-ETS compliance.

Solution

ZeroH provides carbon credit tracking (J-Credit, JCM, voluntary), GX-ETS compliance workflows, TCFD/SSBJ reporting automation, and green finance documentation (bonds, loans) with blockchain verification.

Result

Japanese enterprises can manage carbon credits, comply with GX-ETS, and meet mandatory TCFD/SSBJ disclosure requirements with unified workflows.

Carbon credit tracking (J-Credit, JCM, voluntary)

GX-ETS compliance workflows

TCFD/SSBJ reporting automation

Green finance bond/loan documentation